how to calculate a stock's price

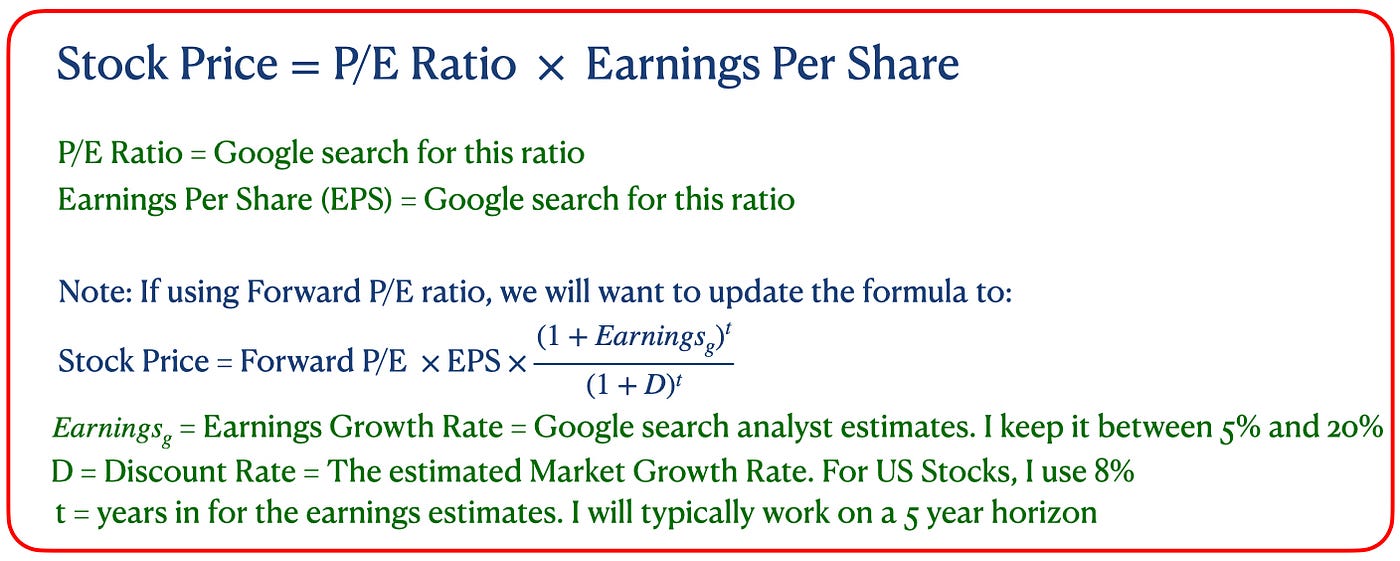

NS is the number of shares SP is the selling price per share BP is the buying price per share SC is the selling commission BC is the buying commission. The formula for PE is a companys stock price at a specific point in time divided by its earnings per share EPS for a specific period.

Read more are 25.

. The price of Stock A is expected to be 10500 per share in one years time P1. Then divide by the number of shares issued. The higher the earnings per share EPS the more profitable the company is.

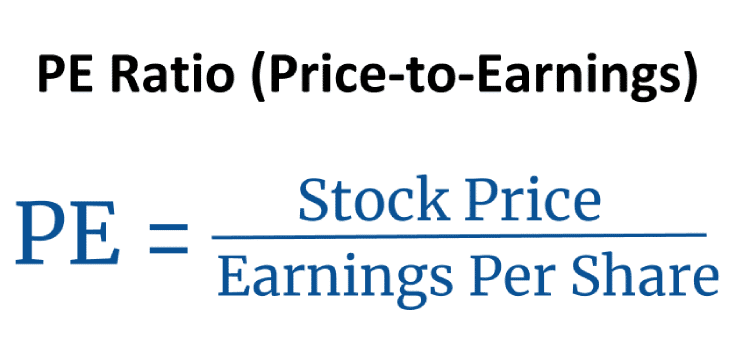

Sum the amount invested and shares bought columns. Divide the total amount invested by the total shares bought. The most common way to value a stock is to compute the companys price-to-earnings PE ratio.

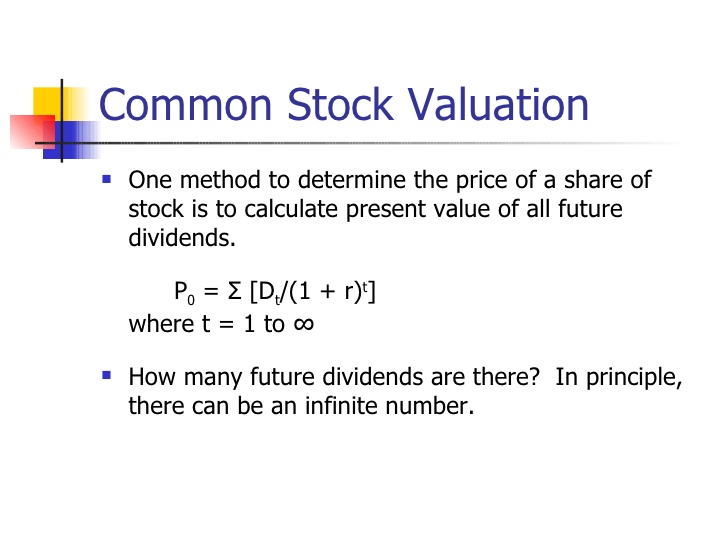

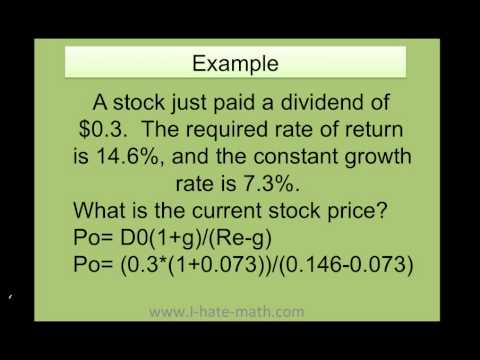

WherePCurrent Stock PricegConstant growth rate in perpetuity expected for the dividendsrConstant cost of equity capital for that company or rate of returnD 1. It is calculated by dividing total earnings or total net income by the total number of outstanding shares. The algorithm behind this stock price calculator applies the formulas explained here.

Book Value per Share. The PE ratio equals the companys stock price divided by its most recently reported earnings per. How to Calculate share value Example.

For example if the price of stock is 50 and it earned 5 per share the PE ratio is 50 divided by 5 which equals 10 or a price-earnings ratio of 10-to-1. Earnings per share is a companys net profit for a period divided by the number of common shares it has outstanding. PE is a measure of a companys stock price relative to net income.

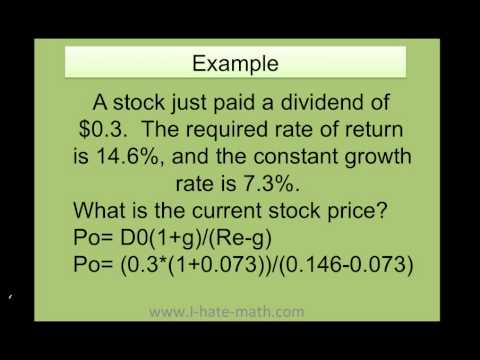

How its calculated. Finding the growth factor A 1 SGR001 Computing the future dividend value B DPS A Calculating the Estimated stock purchase price that would be acceptable C B. Dividends are expected to be 300 per share Div.

Calculating Todays Stock Prices. When a buyer and seller come together a trade is executed and the price at which the trade occurred becomes the quoted market value. In this case the adjusted closing price calculation will be 20 1 21.

You can also figure out the average purchase price for each investment by dividing. Put simply the ask and the bid determine stock price. This will give you a price of 667 rounded to the nearest penny.

The balance sheet with these figures can be found in the companys latest earnings report on its website. A market maker in the middle works to create liquidity by facilitating trades between the two parties. Annual Dividends per share.

The book value is worked out from the balance sheet as total assets minus total liabilities or costs. You should also be able to find that number on the balance sheet. Expected price of dividend stocks One formula used to value dividend stocks is the Gordon constant growth model which assumes that a stocks dividend will continue to grow at a constant rate.

Divide the current share price by the stocks book value. Stock price price-to-earnings ratio earnings per share. Last 12-months earnings per share.

To find the market price per share of common stock divide the common stockholders equity by the average number of outstanding common stock shares. These are easy formulas once getting the terminology down. In this article we will look at four commonly used financial ratiosprice-to-book PB ratio price.

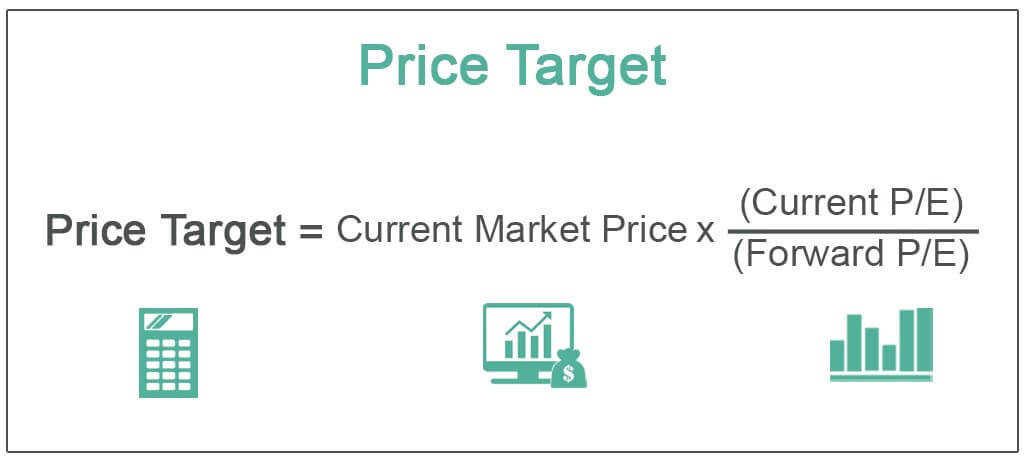

The PE ratio is calculated by dividing the price of the stock by its annual earnings. Once you determine your companys value--and in turn common stock pricing--then you must identify the percentage of your company that each stockholder has including founders employees strategic advisors and investors. Solution Current PE 802 40 Forward PE 8025 32 Calculation of Price Target 80 4032 100 Price Target vs Fair Value.

Taken together they determine what your companys worth including each share of common stock. Price of Stock A is currently 10000 per share or P0. Therefore our capital gain is expected to be 10500 -.

Annual Return Simple Return 1 1 Years Held-1. We can rearrange the equation to give us a companys stock price giving us this formula to work with. Profit P SP NS - SC - BP NS BC Where.

Simple Return Current Price-Purchase Price Purchase Price Now that you have your simple return annualize it. Stock value Dividend per share Required Rate of Return Dividend Growth Rate Rate of Return Dividend Payment Stock Price Dividend Growth Rate. Investing has a set of four basic elements that investors use to break down a stocks value.

The Stock Calculator uses the following basic formula.

Excel Finance Class 65 Calculate Stock Price At Time T Using Dividend Growth Model Youtube

Implied Volatility To Discover Stock Price Expectations Option Party

How To Calculate Future Expected Stock Price The Motley Fool

How Is Market Price Per Share Calculated Quora

How Is A Company S Share Price Determined India Dictionary

Pe Ratio Price To Earnings Definition Formula And More Stock Analysis

Present Value Of Stock With Constant Growth Formula With Calculator

How To Calculate Future Expected Stock Price The Motley Fool

Total Stock Return Formula With Calculator

Price Target Definition Formula Calculate Stocks Price Target

Intrinsic Value Formula Example How To Calculate Intrinsic Value

The Stock Price Of Retro Co Is 65 Investors Required A 12 Percent Rate Of Return On Similar Stocks If The Company Plans To Pay Dividend Of 3 80 Next Year What Growth

How To Calculate Stock Prices With The Dividend Growth Model In Microsoft Excel Microsoft Office Wonderhowto

How To Find The Current Stock Price Youtube

How To Calculate Weighted Average Price Per Share Fox Business

Price Volatility Definition Calculation Video Lesson Transcript Study Com

How To Price A Stock Buy Sell Hold Go Long On A Put By Kk Karan Kumar Medium

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)